Average withholdings from paycheck

Your employer withholds 145 of your gross income from your paycheck. The withholding allowance amount depends on the length of the pay period.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

The Withholding Form.

. Use this tool to. An election of 27 would result in 5400 2000 x 27 54 withheld for Arizona from each paycheck 1404 annually while electing 36 would result in 7200 2000 x 36 72. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

Backup withholding rate remains 24. Topping the list is Tennessee with Minnesota and Massachusetts close behind in. If youre single this is pretty easy.

There are also rate and bracket updates to the 2021 income tax withholding tables. Free salary hourly and more paycheck calculators. The information you give your employer on Form W4.

See how your refund take-home pay or tax due are affected by withholding amount. Subtract 1548 from 222491 to arrive at 67691 which is your excess wages. That would be 3600 in taxes withheld each year.

Add 20105 to 16923 to get total withholding. You find that this amount of 2025 falls in the. Supplemental tax rate remains 22.

Weve identified 11 states where the typical salary for a Withholding Tax job is above the national average. Your employer pays an additional 145 the employer part of the Medicare tax. To put it another way.

FICA taxes consist of Social Security and Medicare taxes. Multiply 67691 by 25 percent to get 16923. FICA taxes are commonly called the payroll tax.

There are no income limits for. Example rates include 10 percent 25 percent 33 percent and 396 percent. These are contributions that you make before any taxes are withheld from your paycheck.

However they dont include all taxes related to payroll. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. On average 82 percent of single-person insurance policy premiums are employer covered.

Of course each business will have. But the IRS introduced a new Form. This means that your federal tax liability increases as you earn more money.

Estimate your federal income tax withholding. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. You can use the Tax Withholding.

That number drops to 71 percent for family plans. Lets say you have 150 withheld each pay period and get paid twice a month. Fewer or zero allowances mean more income tax is withheld from your pay.

For help with your withholding you may use the Tax Withholding Estimator. More allowances equal more take-home pay and money in your pocket. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return.

For example for 2018 the allowance amount is 7980 for weekly pay periods or 15960 for. What is the federal tax.

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Check Your Paycheck News Congressman Daniel Webster

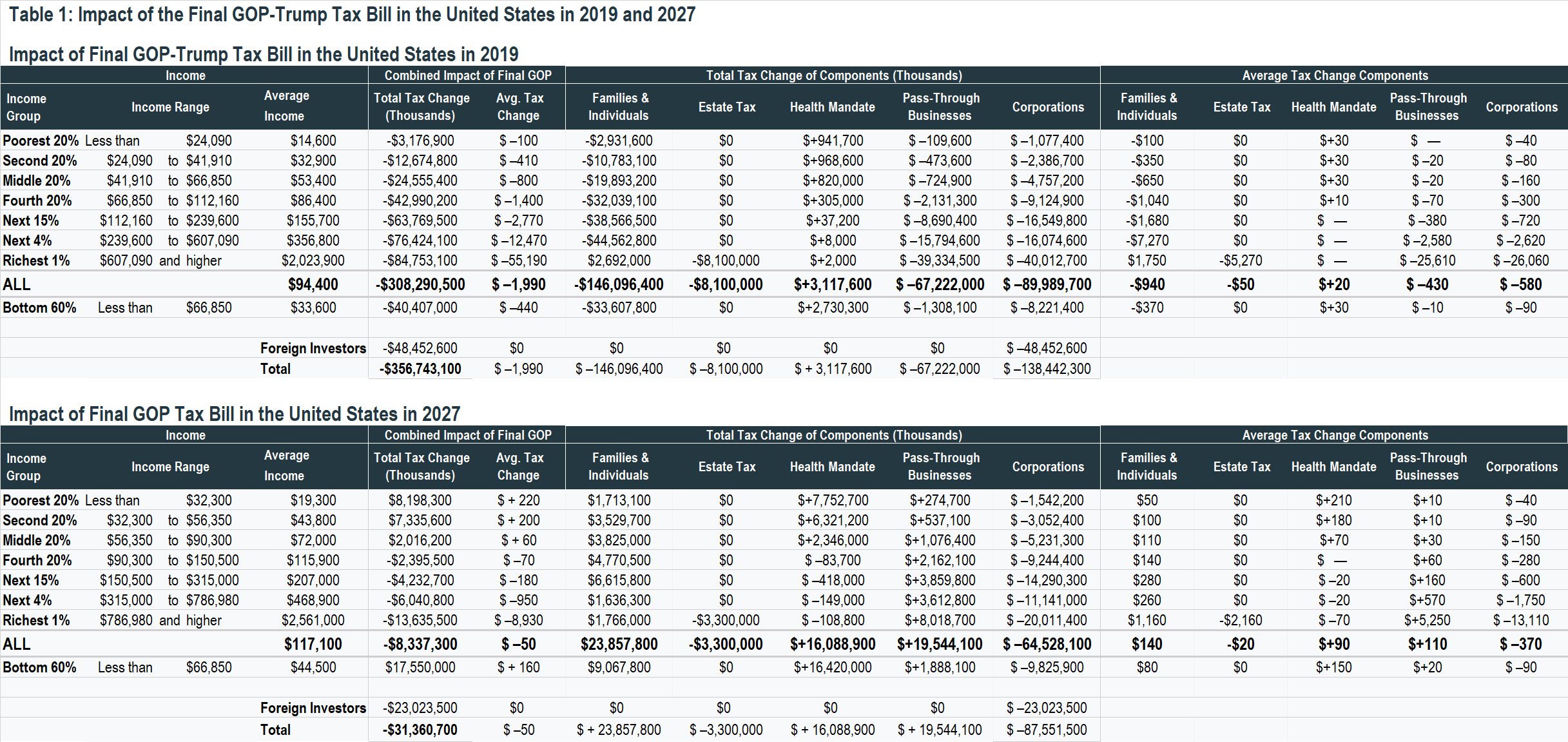

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Paycheck Taxes Federal State Local Withholding H R Block

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Understanding Your Paycheck Credit Com

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Payroll Employee Guide

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your W 2 Controller S Office

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

2022 Federal State Payroll Tax Rates For Employers